Imagine a world where every object, every concept, has potential value-not just in its tangible form but in its very essence. This is the world of monetization. An age-old concept, but one that continues to evolve.

Imagine a world where every object, every concept, has potential value-not just in its tangible form but in its very essence. This is the world of monetization. An age-old concept, but one that continues to evolve.

Monetization is the art and science of a fundamental economic concept that refers to the process of converting non-revenue generating assets, goods, or services into a form of currency or a source of revenue. The term derives from the Latin word “moneta”, linked with the coinage or minting of physical money. From a broader economic viewpoint, monetization can be understood in several nuanced ways:

- 1. Liquidating Assets: This involves converting tangible or intangible assets into a liquid form of money. For example, selling bonds, stocks, or real estate to obtain cash.

- 2. Generating Revenue from Assets: It’s about turning assets or activities that weren’t previously revenue-generating into profitable ventures. For instance, a website with substantial traffic might introduce advertisements to turn its audience reach into a steady income stream.

- 3. Currency Creation: In terms of macroeconomics and national policy, monetization may refer to the act of a government converting its own debt into new money, typically by having the central bank purchase government bonds, thereby increasing the money supply. This is a complex process and can influence inflation rates and other economic indicators.

- 4. Digital Monetization: In today’s digital economy, monetization often refers to ways businesses earn revenue from services or products provided online. This could mean anything from in-app purchases in mobile games to subscription models for software services.

- 5. Expanding Monetization: In economic development contexts, monetization might refer to the development of markets and infrastructures, thereby enabling communities or nations to better capitalize on local resources.

However, monetization isn’t a guaranteed goldmine. While it promises revenue, profitability is a different game, contingent on the market, the cost, and a myriad of other elements. But, boiled down, monetization is all about identifying and unlocking hidden value.

Now, let’s time-travel back to 1519.

In 1519, when Hernán Cortés and his conquistadors arrived in Mexico, they stepped into a world where the notions of value and trade were manifested differently than in their own. The Aztecs, flourishing in their civilization, held gold in esteem-it was cherished for its aesthetic allure and, on occasion, used as a medium of exchange. Yet, their daily transactions were rooted in tangible, day-to-day essentials: cocoa beans or bolts of cloth. To them, the Spaniards’ unwavering fascination with gold was a perplexing enigma. How could this inert metal, no matter its gleam, hold such sway over these foreign invaders?

Cortés’ poetic analogy, suggesting their hunger for gold stemmed from a ‘disease of the heart,’ sheds light on a profound economic impulse. This drive, this urge to monetize, or to derive value from assets, was deeply embedded in the Spanish psyche.

Monetization, again in essence, is about converting or establishing something into a form of legal tender or a source of revenue. It’s an act of recognizing, attributing, and harnessing value. While the Aztecs saw value in the tangible and immediately useful, the Spaniards, coming from a world where monetization had evolved into a complex system, perceived value in the potentiality of assets. Gold, to them, wasn’t just a shiny metal; it symbolized power, wealth, and opportunity. Its value was both immediate, in its ability to be molded into coins and artifacts, and symbolic, representing dominance and prosperity.

For the Aztecs, the concept of monetization was organic, rooted in immediate utility. Their trade items were directly consumable or usable, like food and fabric. The Spaniards, on the other hand, represented an evolved form of this concept. Their obsession with gold was more than just about its intrinsic beauty or immediate utility; it was about its potential to be transformed-to be monetized into coins, jewelry, or other symbols of wealth.

In the meeting of these two worlds, we see a clash of economic philosophies. Tangibility versus symbolism. Instant gratification versus long-term vision. The Aztecs’ cocoa beans and cloth squares, and the Spaniards’ insatiable thirst for gold, highlight the varied human approaches to understanding, assigning, and leveraging value. The story of these two cultures offers a deep dive into the essence of monetization and how it can differ based on perspective, culture, and history.

From this historical juncture, we pivot to the present, where once again, we find ourselves at the cusp of a revolutionary shift in our understanding of value and monetization.

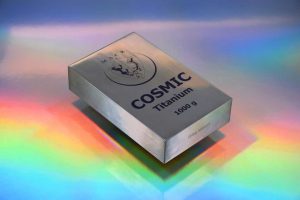

Introducing Cosmic.

As the world grapples with the complexities of digital assets and the expansive realm of virtual currencies, we encounter a new protagonist in the narrative of value: Cosmic. But much like gold for the Spaniards, Cosmic isn’t just about its immediate value. It represents a vision, a potential for a new age of global financial understanding and collaboration.

At its core, Cosmic embodies the potential of assets. Just as the Spaniards saw gold as more than a shiny substance, understanding its potential to represent power and prosperity, Cosmic’s true worth is its potentiality. It’s a decentralized entity, free from the bindings of national agendas or geopolitical shifts. It provides an equal playing field for all, decentralizing economic power and granting it back to the masses.

This supranational currency isn’t tied to a specific nation. Instead, it thrives on a globally recognized consensus of its value. But, its value isn’t solely in its transactional capability. Cosmic, much like the gold for Spaniards, holds a promise-a promise of a unified global economy where value isn’t dictated by borders or political whims but by collective acceptance and utility.

Furthermore, Cosmic is more than just a medium of exchange. It’s a testament to the human spirit’s adaptability and innovation. As we stand on the precipice of technological advancements and digital revolutions, Cosmic serves as a beacon, guiding us into a new era of financial inclusivity, stability, and prosperity.

In conclusion, just as the meeting of the Aztecs and Spaniards signaled a monumental shift in the world’s economic and cultural landscape, Cosmic stands poised to redefine our global financial ethos.

As we navigate this brave new world, it’s vital to embrace both the tangible and symbolic facets of value, ensuring a balanced, inclusive, and prosperous future for all.